The Institute of Cost Accountants of India released a new notification about ICWAI Foundation syllabus 2016. ICWAI announced that they are going to make some changes in CMA Foundation Syllabus from Dec 2016 in that notification. Under ICWAI Syllabus 2016, the first examination is conducted in December, 2016.

CMA Foundation Course Syllabus for 2016

ICWAI has changed the name of ICWAI Foundation course to CMA Foundation Course. The Last Examination under ICWAI Syllabus 2012 is conducted in June 2017 and the First Examination under ICWAI Syllabus 2016 is conducted in December, 2016.

Students who want to prepare for CMA Foundation exam should prepare CMA Foundation Syllabus of 2016 only.

Paper 1: Fundamentals of Economics & Management

Paper 2: Fundamentals of Accounting

Paper 3: Fundamentals of Laws and Ethics

Paper 4: Fundamentals of Business Mathematics & Statistics

ICWA/CMA Foundation Syllabus – Complete Details

Paper 1: Fundamentals of Economics and Management

| Concepts | Weightage |

| Section A: Fundamentals of Economics (50%) | |

| Basic concepts of Economics | 20% |

| Forms of Market | 20% |

| Money and Banking | 10% |

| Section B: Fundamentals of Management (50%) | |

| Management Process | 50% |

Section A: Fundamentals of Economics

- Basic Concepts of Economics – Micro & Macro Economics- The Fundamentals of Economics, Utility, Wealth, Production c) Theory of Demand and Supply, Equilibrium, Theory of Production, Cost of Production

- Forms of Market- Pricing strategies in various forms of markets

- Money and Banking- Definition of Money, Types, Features and Functions, Definition, functions, utility, principles of Banking, Commercial Banks, Central Bank, Measures of credit control and Money Market

Section B: Fundamentals of Management

- Management Process-Introduction, planning, organizing, staffing, leading, control, communication, co-ordination, Concept of Power, Authority, Delegation of Authority, Responsibility, Accountability, Leadership & Motivation – Concept & Theories, Decision-making – types of decisions, decision-making process.

Paper 2: Fundamentals of Accounting

| Concepts | Weightage |

| Section A: Fundamentals of Financial Accounting (80%) | |

| Accounting Fundamentals | 35% |

| Accounting for Special Transactions | 20% |

| Preparation of Final Accounts | 25% |

| Section B: Fundamentals of Cost Accounting (20%) | |

| Fundamentals of Cost Accounting | 20% |

Section A: Fundamentals of Financial Accounting

- Accounting Basics- Accounting Principles, Concepts and Conventions, Capital and Revenue transactions – capital and revenue expenditures, capital and revenue receipts, Double entry system, Books of prime entry, Subsidiary Books, Cash Book, Journal, Ledger, Trial Balance , Depreciation – Methods (Straight Line and Diminishing Balance methods only) , Rectification of Errors, Opening entries, Transfer entries, Adjustment entries, closing entries, Bank Reconciliation Statements

- Accounting for Special Transactions- Bills of Exchange, Consignment, Joint Venture

- Preparation of Final Accounts:

a) Of a Profit making concern- Accounting treatment of bad debts, reserve for bad and doubtful debts, provision for discount on debtors and provision for discount on creditors, Preparation of Trading Account, Profit & Loss Account and Balance Sheet.

(b) Of a Not-for- Profit making concern- Preparation of Receipts and Payments Account, Preparation of Income and Expenditure Account

Section B: Fundamentals of Cost Accounting [20 Marks]

Fundamentals of Cost Accounting- Meaning, Definition, Significance of Cost Accounting, its relationship with Financial Accounting & Management Accounting, Classification of Costs

Paper 3: Fundamentals of Laws and Ethics:

| Concepts | Weightage |

| Section A: Fundamentals of Commercial Laws (60%) | |

| Indian Contracts Act, 1872 | 40% |

| Sale of Goods Act, 1930 20% 3. Negotiable Instruments Act | 20% |

| Negotiable Instruments Act, 1881 | 10% |

| Section B: Fundamentals of Ethics (30%) | |

| Ethics and Business | 30% |

Section A: Fundamentals of Commercial and Industrial Laws

- Indian Contracts Act, 1872 – Essential elements of a contract, offer and acceptance, Void and voidable agreements, Consideration, legality of object and consideration, Capacity of Parties, free consent, Quasi-Contracts, Contingent Contracts, Performance of contracts, Discharge of contracts, Breach of Contract and Remedies for Breach of Contract

- Sale of Goods Act, 1930 – Definition, Transfer of ownership, Conditions and Warranties, Performance of the Contract of Sale, Rights of Unpaid Vendor, Auction Sales

- Negotiable Instruments Act, 1881-Negotiable Instruments-Characteristics of Negotiable Instruments, Definitions of Promissory Note, Bill of Exchange and Cheque, Differences between Promissory Note, bill of exchange and Cheque, Crossing – Meaning, Definition, and Types of Crossing.

Section B: Fundamentals of Ethics

- Ethics and Business- Ethics – Meaning, Importance ,The “Seven Principles of Public Life” – selflessness, integrity, objectivity, accountability, openness, honesty and leadership , The relationship between Ethics and Law ,Ethics in Business

Paper 4: Fundamentals of Business Mathematics and Statistics

| Concepts | Weightage |

| Section A: Fundamentals of Business Mathematics (40%) | |

| Arithmetic | 20% |

| Algebra | 20% |

| Section B: Fundamentals of Business Statistics (60%) | |

| Statistical representation of Data | 10% |

| Measures of Central Tendency and Dispersion | 30% |

| Correlation and Regression | 10% |

| Probability | 10% |

Section A: Fundamentals of Business Mathematics [40 Marks]

- Arithmetic- Ratios, Variations and Proportions, Simple and Compound interest, Arithmetic Progression and Geometric Progression.

- Algebra- Set Theory, Indices and Logarithms ,Permutation and Combinations, Quadratic Equations

Section B: Fundamentals of Business Statistics [60 Marks]

3. Statistical Representation of Data- Diagrammatic representation of data, Frequency distribution, Graphical representation of Frequency Distribution – Histogram, Frequency Polygon Curve, Ogive, Pie-chart

4. Measures of Central Tendency and Dispersion- Mean, Median, Mode, Mean Deviation, Range, Quartiles and Quartile Deviation, Standard Deviation, Co-efficient of Variation, Karl Pearson and Bowley’s Co-efficient of Skewness

5. Correlation and Regression- Scatter diagram, Karl Pearson’s Coefficient of Correlation, Regression lines, Regression equations, Regression coefficients

6. Probability –Independent and dependent events; mutually exclusive events b) Total and Compound Probability; Baye’s theorem; Mathematical Expectation

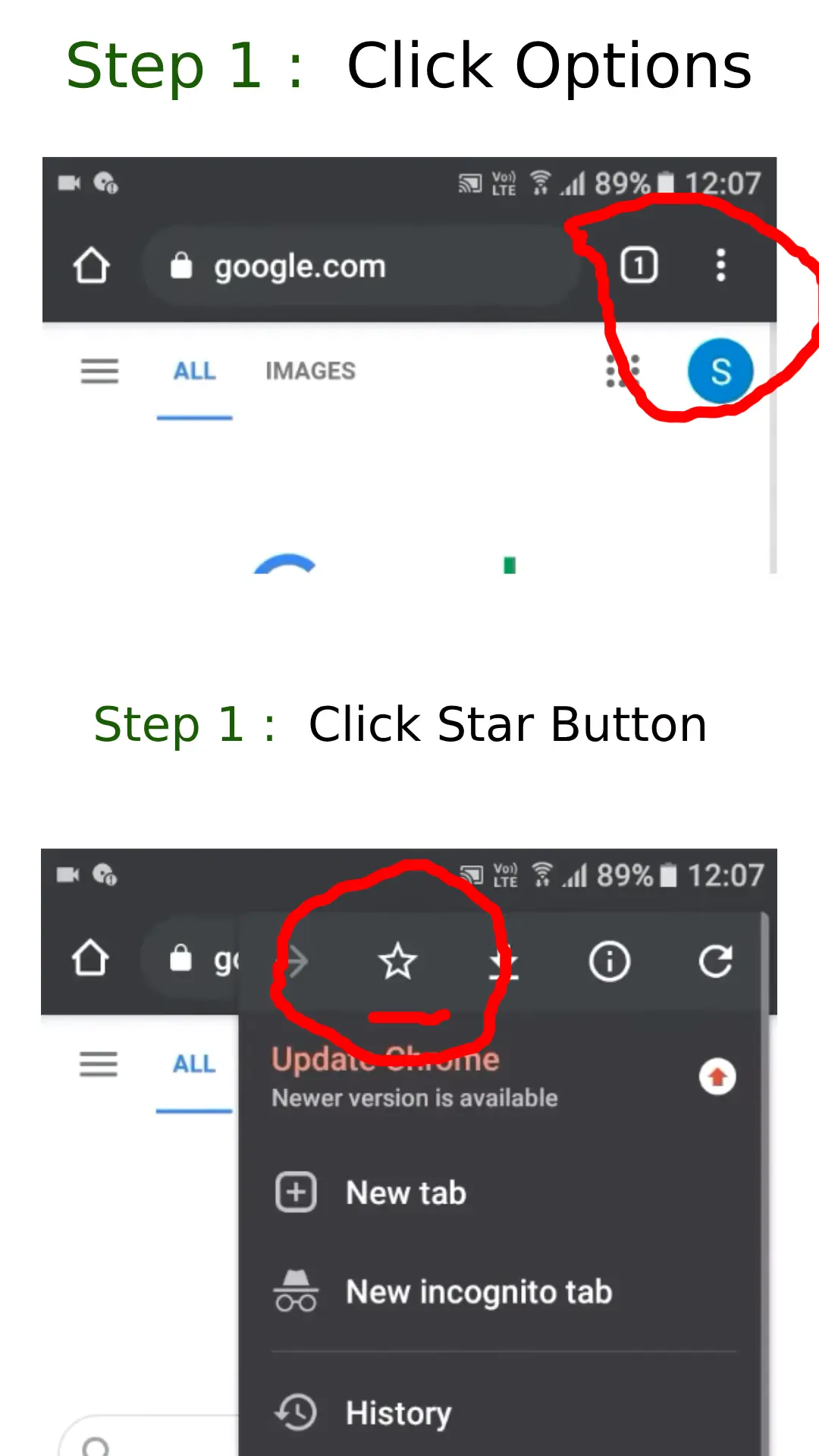

If Interested Please Download